If you run a company, you have to keep track of your profits and expenditures. Your business accounting is needed for taxes, and putting a little more work will save a lot of time and trouble when tax season rolls around. What’s more, precise monitoring of expenses will help you lower your tax bill. But most accounting software isn’t inexpensive, and it can take a lot of time to understand how it operates.

How Does Accounting Software Work?

Accounting applications can be cloud-based or can be downloaded on a desktop computer. Users usually pay monthly subscription fees to use applications that can range from basic, often DIY services to sophisticated and personalized solutions.

The customer selects the form of software based on their budget and the necessary functionality, then inputs the data and scans the receipts. They can also attach the software to their bank, credit card accounts, and other services such as expense monitoring apps.

Accounting software usually has built-in spreadsheets and templates that you fill out; then it automatically completes analyses and guarantees correct totals. It can create reports to satisfy multiple users. It can be used in tandem with your accountant, or even independently of your accountant if you know what you’re doing.

Here are some of the best top accounting software choices to choose from for your company.

Xero

For just $11 a month, you can send custom invoices, balance bank statements, collect receipts for better recordkeeping, and track inventory.

But as a small-business accounting platform, Xero stands out on the shared front. Unlike virtually every other accounting solution (including QuickBooks and FreshBooks), Xero’s services provide unrestricted users. You don’t have to spend more to assign responsibilities such as bank reconciliation or cost monitoring to another team member: time-saving coordination is part of your price.

However, Xero’s $11 a month package limits you to enter only five bills and send only 20 invoices per month. You can send unrestricted invoices and quotations with only Growing and Established Plans beginning at $32 and $62 a month, respectively. Plus, you’ll only get multi-currency payment assistance, cost monitoring, and project management for a $62 plan—many other accounting software solutions provide multi-currency support and front-end tracking.

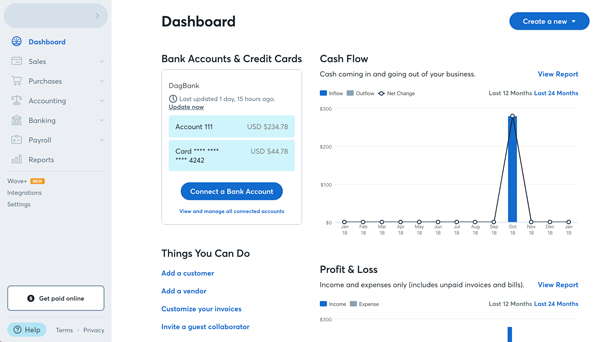

Wave

At a stunning starting price of exactly $0, Wave provides you with a slick, user-friendly dashboard and a host of features that rival those of its paying rivals. For example, Wave Accounting requires multi-currency assistance, cost analysis, unlimited invoicing, and double-entry accounting—a more precise accounting approach that FreshBooks’ cheapest plan is noticeably missing.

Wave also lets you juggle several companies on the same budget, meaning you can keep track of both sets of finances without spending anything.

While Wave has a handy payroll tool, its accounting program is not exactly the best one for organizations with hundreds of employees. Since Wave provides only one accounting plan, companies cannot upgrade to plans with more features as they expand. And Wave’s lack of product monitoring makes it best tailored to service-based solo entrepreneurs and freelancers.

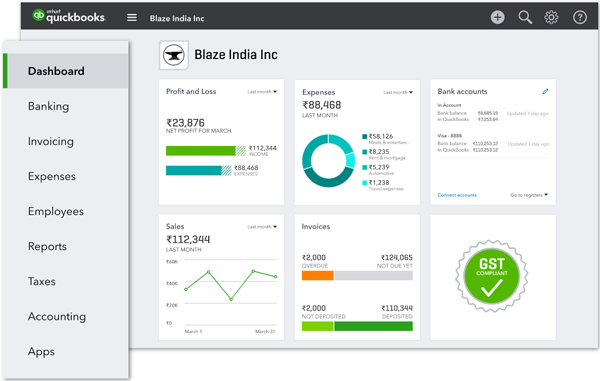

QuickBooks Online

Intuit, the parent company of QuickBooks, has a reliable reputation as one of the most reputable suppliers of financial, tax, and accounting tools. QuickBooks Online, Intuit’s cloud-based accounting software solution, provides standard functionality such as payment, billing, and receipt scanning—and even the cheapest plan includes more detailed monitoring than many competitors:

- Mileage tracking

- Sales tax tracking

- Automatic tax deduction categorization

- 1099 contractor payment tracking

In addition to helping consumers to manage more data points than many rivals, QuickBooks also provides the very best mobile accounting software you can find. If you’re working on the go, the QuickBooks app and the mileage tracking could make it a good match.

QuickBooks’ stellar reporting capabilities come at a premium, though: the cheapest small business package starts at $25 a month and limits you to one customer plus one accountant. Its most precious package, which makes 25 people, starts at $150 a month. You can take it for a spin with a 30-day free trial, but if you do, keep in mind the QuickBooks’ 50 percent off the first three-month contract.

FreshBooks

![]()

FreshBooks helps you to submit an infinite number of invoices and projections for each plan. Each schedule also provides time monitoring for faster, more reliable consumer billing, plus cost tracking to keep your budget balanced.

FreshBooks, though, is not ideal for collaboration. If you want to connect users to your account, you’re going to spend an additional $10 a month per account. Solopreneurs and freelancers are not supposed to have an expensive relationship with FreshBooks. But companies who need more than one pair of eyes on their budgets can try out Xero or a provider like QuickBooks that places extra customers in their higher-level plans.

FreshBooks also caps the number of customers you can charge every month because while you can give these customers an infinite number of invoices, you can’t get more than five clients on your list. That means the cheapest FreshBooks package fits well for freelancers and ultra-small businesses. Midsize and growing companies will choose to choose the Plus Package, which restricts you to 50 billable customers, or the Premium Plan, which limits you to 500.

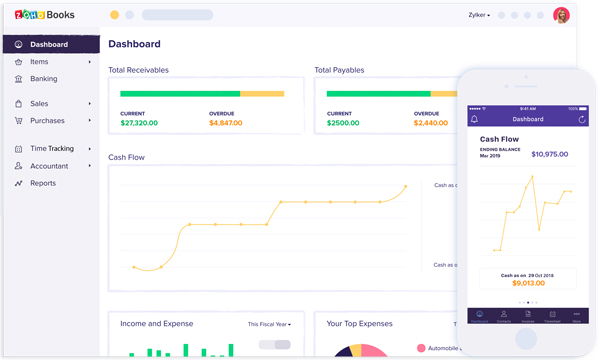

Zoho Books

Zoho Books effectively automates the most common accounting tasks—which ensures that you can devote more attention to your company and clients and less time to the tiresome task of data entry. Most importantly, it helps you to set automatic consumer payment alerts, create recurring cost accounts, and automate inventory monitoring.

Also, Zoho Books is only one piece of software in Zoho’s broader suite of items. Each Zoho product combines seamlessly with the others, which means that you can start using Zoho for accounting, project management, and customer relationship management (CRM). Zoho Books launch at $9 a month—$2 less than Xero. You’re going to spend another $2 a month per extra account, which is a fantastic price compared to FreshBooks’ $10 per user.

Unfortunately, even though it’s a solid accounting product, Zoho Books has one major flaw: Zoho doesn’t provide a payroll package unless you work in California, Texas, or India. And it doesn’t integrate with third-party payroll suppliers either. Instead, you ought to manually change the payroll-related elements of the books—which greatly contradicts Zoho’s primary capacity to automate.

Is Accounting Software Worth the Cost?

Accounting software is generally cheaper than an accountant and more reliable than keeping track of the documents by hand. If you want to save money on your taxes, keep track of your spending, and correctly fill out tax forms to prevent audits, then accounting software is certainly worth the cost.

Using accounting software keeps you updated and up-to-date with your company records and is a valuable guide for analyzing your finances and deciding what adjustments, if any, should be introduced.